Quick take:

- Analysts are predicting metaverse real estate to record at least $1 billion in sales this year.

- Digital land sales rocketed to $501 million last year according to MetaMetric Solutions.

- The analytics firm said virtual land sales have already surpassed $85 million this year.

The metaverse hype is shaping out to be more than just gaming and NFTs. According to data compiled by analytics firm MetaMetric Solutions, land sales from the top four platforms in the metaverse surged to $501 million last year.

The metaverse data provider now expects the digital real estate market to double last year’s sales in 2022 to $1 billion after locking more than $85 million in January.

The firm cites Facebook’s rebranding in October as a major catalyst in the recent surge in virtual real estate sales. It said sales rocketed to $133 million in November following the social media giant’s vital announcement.

Although digital land sales are no longer recording exponential growth figures, this January’s figure of $85 million is still ten times higher compared to the same month last year.

A recent report from BrandEssence Market Research predicts the metaverse real estate market will experience a compound annual growth of 31% between 2022 and 2028.

However, although investors could reap huge rewards from investing in the highly popularised segment of the metaverse, Janine Yorio, CEO of Republic Realm, a metaverse real estate investor and advisory firm warns the risks involved are as high.

“There are big risks, but potentially big rewards,” Yorio told CNBC.

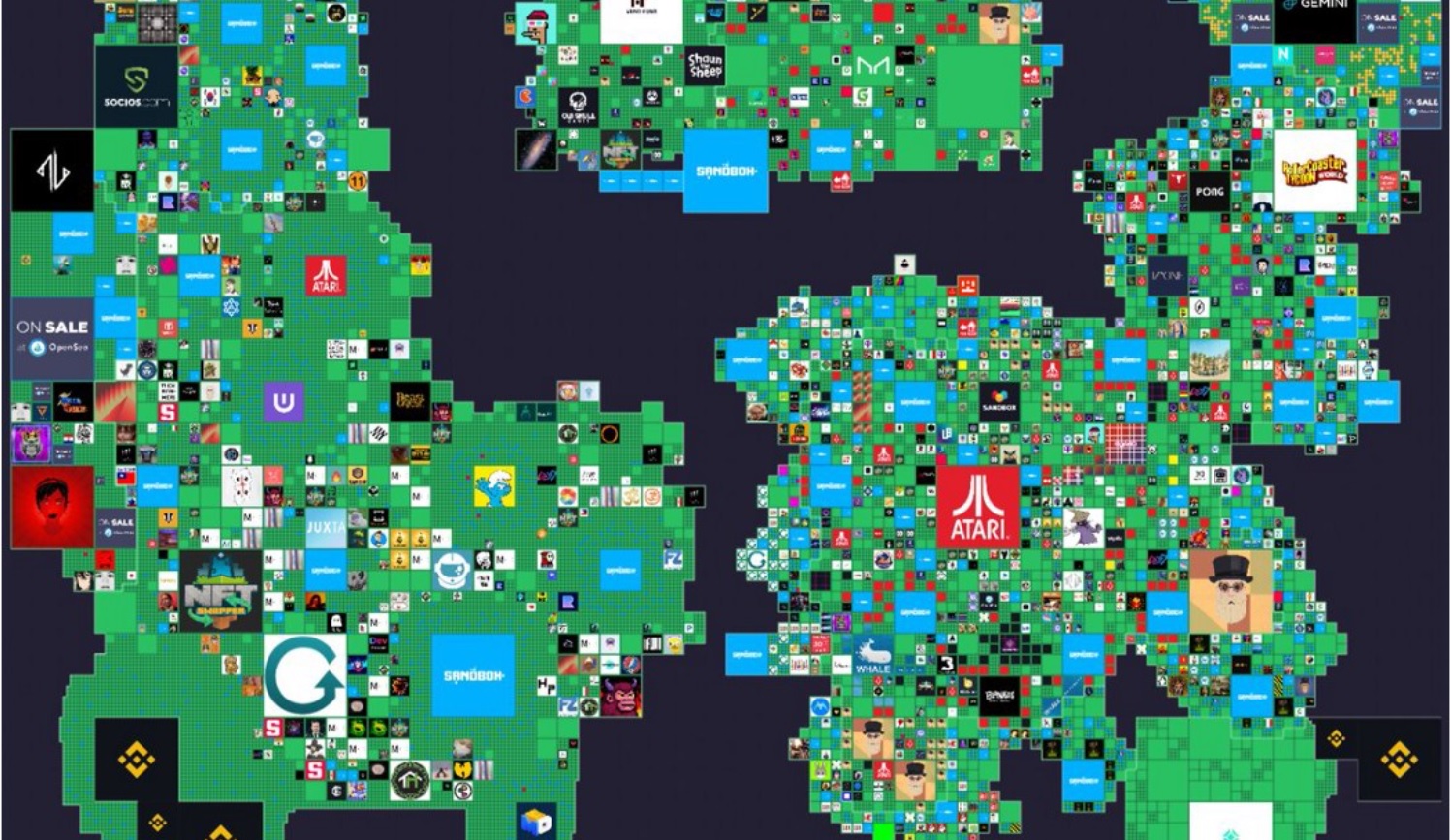

The Sandbox is the largest metaverse landowner with 62% of all available metaverse land. It is followed by Decentraland, Cryptovoxels and Somnium. These four are driving the rapid growth of virtual real estate.

However, traditional investors are finding it difficult to embrace the metaverse craze likening digital land sales to a pyramid scheme. Edward Castronova, professor of media at Indiana University, cites Second Life’s unexciting digital land project from 20 years ago, which failed to meet expectations.

“Metaverse land sales are generally a pyramid scheme and have been for more than 20 years,” he said, adding that the metaverse is El Dorado for internet startups that “chase it into the forest and die.”

On the other hand, Andrew Kiguel, CEO of Toronto-based Tokens.com, which recently raised $16 million to invest in metaverse real estate thinks the issue has more to do with a difference in culture than a lack of intrinsic value.

“The problem a lot of people have is that there are generations that have a difficult time attributing value to things that are digital, that you can’t hold and that don’t have weight,” Kiguel said, adding that the younger generation is more attuned to the value of digital technologies like NFTs, blockchain games and the metaverse.

Stay up to date:

Credit: Source link